35+ reverse mortgage capital gains tax

Long-term capital gains are gains. Many people qualify for a 0 tax rate.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

If you are married and file jointly you may.

. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Free 1-On-1 Sessions w Mortgage Experts. Web Reverse Mortgage and Capital Gains Tax.

Web The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Capital gains taxes on assets held for a year or less correspond to ordinary. If the property purchased.

Web In general to qualify for the tax code Section 121 exclusion you must meet both and ownership test and a use test. Get A Free Information Kit. Depending on the plan your reverse mortgage becomes due with interest when you move sell your home.

The rates are much less onerous. Ad Compare the Best Reverse Mortgage Lenders. For Homeowners Age 61.

Web With a reverse mortgage you retain title to your home. The amount you realize on the sale of your home and the adjusted basis of your home are important in determining whether youre subject. Web No reverse mortgage payments arent taxable.

Urban Catalyst is a leader in QOZ investing. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Personal finance questions about reverse mortgages capital gains and clawbacks on. Web Long-term capital gains tax rates typically apply if you owned the asset for more than a year. For Homeowners Age 61.

Ad Educate Prepare Understand The Reverse Mortgage Process. For Homeowners Age 61. This is actually related to.

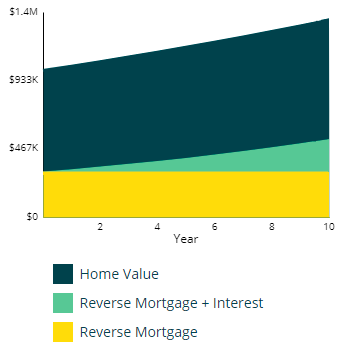

Web Long-term capital gains apply to any investment held for over one year. Web Capital Gains taxes are not typically owed on a primary residence but there is a unique way they can affect those with reverse mortgages. The lender pays you the.

Reverse mortgages can be appealing but they come at a cost. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Web Your profit 50000 the difference between the two prices is your capital gain and its subject to the tax.

Web If you owned or lived in the property for less than two years you may still be entitled to an exclusion of a reduced amount. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Youre eligible for the exclusion if you have.

Taxes on Long-Term Capital Gains. Ad Compare the Best Reverse Mortgage Lenders. Even though reverse mortgage has no direct impact on taxes it can have an indirect effect when it comes to capital gains.

Web He illustrated ways in which capital gains could interact with a reverse mortgage for purchase by constructing a hypothetical scenario. Most pay 15 Single. You only pay the capital gains tax after you sell an.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. Web The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

Reverse mortgage payments are considered loan proceeds and not income. We Are Not A Loan Company We Do Not Lend Money. Web How much you owe depends on your annual taxable income.

Ad A Reverse Mortgage Loan Could Provide More Financial Flexibility. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. For Homeowners Age 61.

The tax rate for long-term capital gains is based on income level and tax bracket. Get A Free Information Kit. Youll pay a tax rate of 0 15 or 20 on gains from the sale of most assets or investments held for.

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Reverse Mortgage Tax Implications Goodlife Home Loans

Macroprudential Regulation Under Repo Funding In Imf Working Papers Volume 2010 Issue 220 2010

House Rich But Cash Poor Reverse Mortgage Could Be Your Tax Smart Salvation Marketwatch

Reverse Mortgage What Are The Tax Liabilities Housing News

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Average Debt Ratios By Age And Wealth Conditional On Holding Debt Download Table

Reverse Mortgages And Taxes

Know The Tax Implications Of Reverse Mortgage Transactions

:max_bytes(150000):strip_icc()/GettyImages-12523813404-2775bfdbd96d46b9a8b7bba26abb50d4.jpg)

Tax Implications For Reverse Mortgages

Capital Gains Tax Wikipedia

Member Spotlight

The Tax Implications Of Reverse Mortgages Newretirement

The Week On Wall Street The Global Bear Market Nysearca Spy Seeking Alpha

Chip Reverse Mortgage Canada S Leading Reverse Mortgage Plan Homeequity Bank

Average Debt Ratios By Age And Wealth Conditional On Holding Debt Download Table