The formula of profit

The formula to calculate profit is. Profit percentage is a top-level and the most common tool to measure the profitability of a business.

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

After this step the profit percentage can be calculated using the formula ProfitCost Price 100.

. The profit formula is stated as a percentage where all expenses are first subtracted from. To calculate the percentage of profit earned from a particular sale the formula that is used is. Profit is always based on the Cost price.

Net sales are equal to total gross sales less returns inwards and discount allowed. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. In order to calculate profit and loss the concepts of fraction and percentage are used.

Net Profit Margin Formula. Profit and Loss Percentage Formula. The formula for Operating Profit Margin is similar to other profitability ratios.

The formula of gross profit margin or percentage is given below. Gross profit is one of the easiest financial metrics to calculate. The target profit formula is a calculation used by businesses to estimate how much revenue the company should produce over a set period of time.

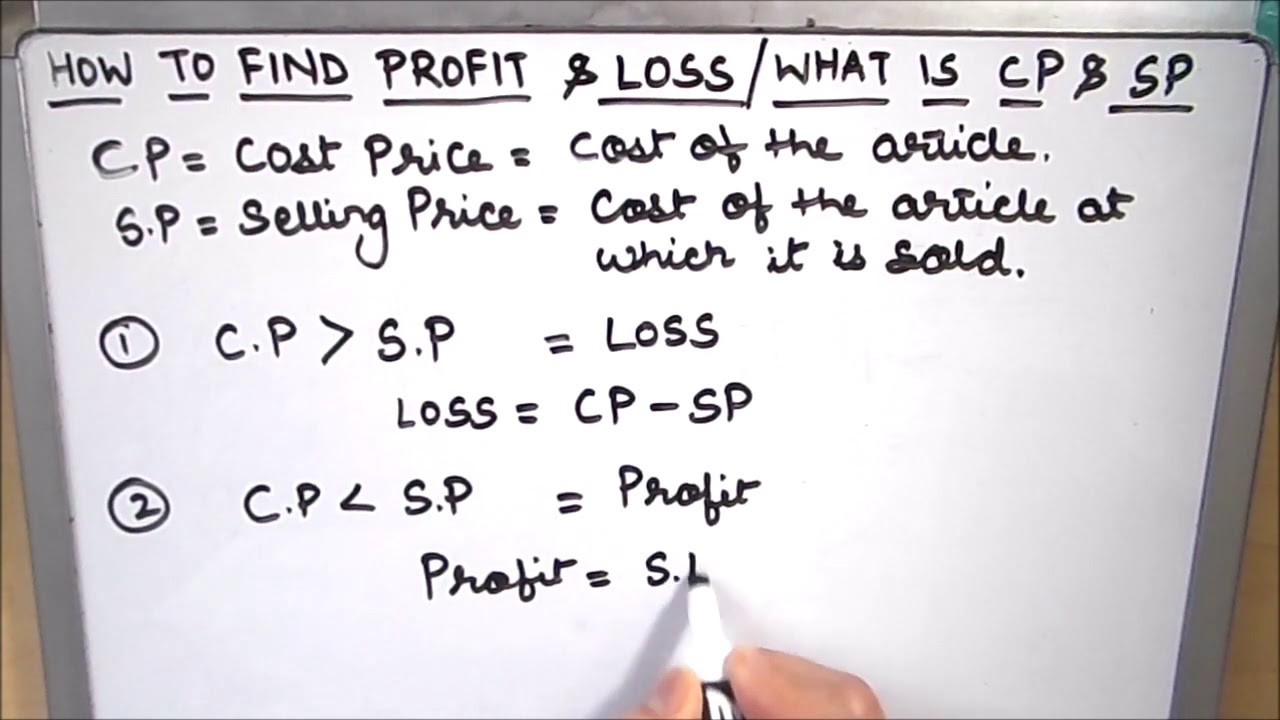

Gross profit is equal to net sales minus cost of goods sold. X profit price. Find the profit or loss using the profit formula then convert it to a profit or loss percentage by expressing it as a fraction with the.

What is the Profit Percentage Formula. Gross profit percentage formula Gross profit Total sales 100 read more. So if the selling price of the commodity is more than the cost price then the business has gained its profit.

Profit Percentage Formula ProfitCP 100. Again the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below. Gross Profit Revenue - Cost of Revenue.

It measures the ability of the firm to convert sales into profits. What is Gross Profit Formula. To calculate gross profit youll need to subtract the cost of goods sold COGS from revenue.

Operating profit is the profit that the company makes before paying interest expense and taxes. There are two main reasons why net profit margin is useful. The profit before tax formula is as follows.

For example lets imagine a coffee shop with 200000 in revenue sales per year. In the table shown we have price and cost but profit is not broken out separately in another column so we need to calculate profit by subtracting Cost from Price. How to calculate gross profit.

The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales. To calculate the profit margin of a business most organizations use the following formula. The concept is used to judge the ability of an entity to set reasonable price points manufacture goods cost-effectively and operate in a lean manner.

The gross profit formula is used to determine a companys gross profit for a financial year. Profit Margin Formula. Direct costs can include purchases like materials and staff wages.

X price-cost price x 5-4 5 x 1 5 x 020. Profit is explained better in terms of cost price and selling price. The profit margin formula is net income divided by net sales.

Ie 20 means the firm has generated a. Profit before tax Revenue Cost of goods sold Operating expenses Interest expenses. 25 is made towards meeting the fixed expenses and then the profit comparison for PV ratios can be made to find out which product department or process is more profitable.

Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period. Hence it is also called as Earnings before Interest and Taxes EBIT. Using the above formula Company XYZs net profit margin would be 30000 100000 30.

The profit formula is the calculation used to determine the percentage profit generated by a business. Cost price is the actual price of the product or commodity and selling price is the amount at which the product is sold. ABC is currently achieving a 65 percent gross profit in her furniture business.

In the above example for every Rs. Profit Total Sales Total Expense. Usually companies use this metric to help establish budgets forecast development potential and optimize investments.

Why Net Profit Margin Is Important. Profit before tax example. Operating Profit Margin formula.

The general formula where x is profit margin is. Relevance and Use of Profit Percentage Formula. The formula simply subtracts the cost of revenue from the revenue.

Profit Margin Net IncomeNet Sales x 100. Shows Growth Trends. Since target profit is an estimation its important to remember that the actual.

Formula to calculate profit before tax. Total Revenue - Total Expenses Profit. Here is an example to show you how the profit before tax formula is calculated.

Finally the formula for profit can be derived by subtracting the total expenses step 2 from the total revenue step 1 as shown below. Fixed costs are not included in the gross profit formula but only the variable costs. Profit before tax EBIT Interest expenses.

In certain cases profit or loss is calculated as a percentage of the cost price. The gross profit formula needs the revenue earned for that year by a company and the cost of the goods sold for that year in the company. Operating Profit vs Net Profit Operating Profit Vs Net Profit Operating profit is derived from gross profit and is the income left after deducting all expenses and costs incurred in the operation of the business.

100 sales Contribution of Rs. Profit is determined by subtracting direct and indirect costs from all sales earned. Higher the PV ratio more will be the profit and lower the PV ratio lesser will be the profit.

Cost Of Goods Sold Formula Calculator Excel Template Cost Of Goods Sold Cost Of Goods Excel Templates

How To Find Profit And Loss Calculate Profit And Loss Using Formula Youtube Profit And Loss Statement Profit Math Videos

Profit And Loss Formulas By Bhumika Agrawal Studying Math Basic Math Skills Maths Formula Book

Pricing Formula Startup Business Plan Small Business Plan Bookkeeping Business

Pin On Maths

Profit Loss Profit And Loss Important Formulas Youtube Math Methods Maths Ncert Solutions Free Math Centers

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Net Profit On Sales Accounting Play Accounting Basics Bookkeeping Business Accounting And Finance

Profit And Loss Basics And Methods Examples Math Tricks Math Tricks Math Profit

Simple Interest Compound Interest Continuously Compounded Interest Studying Math Math Methods Simple Interest Math

Profit And Loss Formula Profit And Loss Questions Profit And Loss Notes Pdf Profit And Loss Notes For Ssc Cgl Profit And Los Math Notes Math Math Questions

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

How Do You Find Percentage Profit Or Loss Maths Formula Book Math Formulas Find Percentage

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infograph Financial Literacy Lessons Economics Lessons Finance Education

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a Http Www Aplustopper Com Profit Loss Rs Aggarwal Cla Maths Solutions Math Methods Math Formulas

Profit And Loss Profit And Loss Formula Youtube Education Math Loss Profit

Comparing Quantities Class 8 Notes Maths Chapter 8 Learn Cbse Class8mathsnotes Comparingquantitiesno Math Formula Chart Simple Interest Math Studying Math